The other set of rules I need to create is my trading system. There are a

TON of technical indicators available,

no really. The key is building a select few into a trading system. There is no "golden bullet" indicator, they all have flaws, they are all wrong at times (hopefully different times). The more I read about the various indicators the more it appears they are very similar to one another.

As I see it there are three main groups: (search investopedia for descriptions I'm not going to link each one)

- Chart patterns ("Head and shoulders", triangles, flags, sushi rolls, doji stars, fibonacci fans / retracements, etc.)

- Trend indicators (MACD, DMI, Bollinger / Keltner Bands, etc.)

- Supply / Demand oscillators (CMO, Stochastics, RSI, MFI, etc.)

Chart patterns are shapes or patterns that can be seen by examining historical price data. Usually the pattern or shape itself isn't an indicator, but the price data breaking the boundries of the patter or shape is the indication of future movement in a particular direcion. For example, if a previous point of support is broken (price hit a certain low then rebounded on several occasions until finally falling below the "rebound" point), then that penetration is an indication that prices will continue to move lower in the future. I included fibonacci fans / retracements here because they to point to "decision" levels for price, if a stock retraces 33% of it's gain / loss you need to examine if it will change direction or continue.

Trend indicators show the direction of a trend, the strength of a trend, and sometimes both. They tend to "lag" behind current price data. So while a chart pattern may indicate a reversal of direction the trend indicator will verify it a few data points later, in general.

Oscillators generally indicate where the stock price is in terms of supply and demand. A high value usually indicates the stock is "overbought", lots of people buying the stock have driven up the price. A low value indicates the reverse, lots of sellers creating oversupply and driving down he price.

Dr. Alexander Elder put together a "

Triple screen Trading System" in his book

Trading for a Living (very good book). I like the system, as it combines various indicators to compensate for each others weaknesses. The first step is to determine my "trade horizon", or how long I intend to be in each trade. Day traders have horizons in terms of hours, buy and hold types have horizons in terms of years; I'm looking at days or a few weeks (only 5 days in a trading week). Once I have my horizon (measured in days), this will become the data grouping to examine intermediate trends. So when looking for intermediate trends I will use charts showing daily price data. Long trends will be an order of magnitude larger, so I will use charts with weekly data to determine long trends. Short trends will be an order of magnitude smaller, so I will use charts with hourly data to determine short trends. An analogy Dr. Elder uses is Tides, Waves, and Ripples.

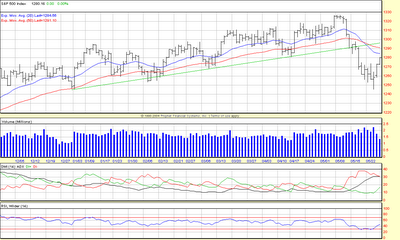

The first screen employs a trend following indicator to determine the direction of the long term trend (Tide). I will be using weekly price data represented with a

Heikin-Ashi Candlestick representation, this helps smooth out "noise" and make the prevailing trend more obvious. A

MACD indicator will be my primary indicator of trend direction, and an

ADX indicator will help me confirm the strength of the trend. Chart analysis techniques (Candlestick patterns, Fiboniacci fans / retracements) will be used as additional confirmation for trend diretion changes.

The second screen uses oscillators to identify consolidations (Waves) during the prevailing trend (Tide), a temporary fall or sideways action during an uptrend signals a good point to enter the trend ("buy low" afterall). I will use daily price data in both Candlestick and Bar representations. An

EFI (Elder Force Index) oscillator will be my primary indicator, with a

CMO (Chande Momentum Oscillator) providing confirmation of "over bought / sold" conditions. Again chart patterns will provide additional confirmation. Since oscillators can give false signals during longer trends (ie. A long uptrend will have an oscillator showing "overbought" conditions for some time as buyers continue to drive the price up over a longer period.), employing them as a second screen after determining the longer trend allows me to identify which signals to ignore. Continuing the example, if the long term trend is up only oscillator signals saying "buy" will be used; the "sell" signals will only be used if the long term trend changes.

The third screen doesn't need many analytical tools. Once an entry point has been confirmed in the second screen, an order is entered just outside the previous day's boundaries. Continuing the example; the long term trend is up, the mid-term trend identifies a temporay pull back, the third sceen looks at the previous day's hourly action and a

stop-buy order is placed

above the previous day's

high. On the next trading day, if the price rises (as predicted by the first screen) the buy order is executed and we got into the up trend at a low point. If the price decreases (as predicted by the second screen) then the stop-buy is adjusted to just above that day's high, as long as the primary long term trend has not changed this will ensure we enter the uptrend at the lowest point.

This covers when to

enter a trade, equally (some would say

more) important is when to

exit the trade. After the position is acquired a stop-loss order is placed on the opposite side of the day's boundaries. Finishing the example, yesterday the stock was purchased; a

stop-sell order is placed just

below yesterday's

low. If the trend changes rapidly, we are spared the minimum loss. If the trend continues as we predicted in the first screen, then the

stop-sell order can be increased steadily to lock in profits.

I'll have to use a small change to the Dr. Elder's system. Since my money management rules preculde my from buying sizeable amounts of the stocks I'll be screening (DJIA members); I'll be buying options instead. The frist two screens will be unchanged, but the third screen will examine the daily price movement of the related stock

option.

Stop-buy and

stop-sell orders will be applied in the same fashion.

Up next, an example of the Triple Screen System in action ...

Current TradesWhat is it? BlahBlah

Ticker: XXXX

Cost: $X.XX

Value: $X.XX

Exit Point: $X.XX

Trading Account SummaryCurrent Balance: $X.XX

Current Value: $X.XX

Highest Value: $X.XX

Lowest Value: $X.XX

Highest Drawdown: XX%